[ad_1]

In Todays Headline TV CryptoDaily News:

https://www.youtube.com/watch?v=5sHwClrU5uI

Ethereum price needs to overcome two hurdles.

Ethereum price behaved in an unexpected way after the Merge update. Interestingly, ETH sold off after the highly-anticipated event, which has pushed to retest a stable support area, potentially triggering a run-up.

Flashbots build over 82% relay blocks, adding to Ethereum centralization.

Following the completion of The Merge upgrade, Ethereum transitioned into a proof-of-stake consensus mechanism, helping the blockchain become energy efficient and secure. However, mining data reveals Ethereum’s heavy reliance on Flashbots — a single server — for building blocks, raising concerns over a single point of failure for the ecosystem.

Disgraced at-large crypto founder Do Kwon denies he’s on the run.

Do Kwon, the founder of the collapsed Luna and TerraUSD tokens, said he’s not “on the run” hours after Singapore police stated that he was no longer in the country. Kwon, along with five others, is facing arrest in South Korea.

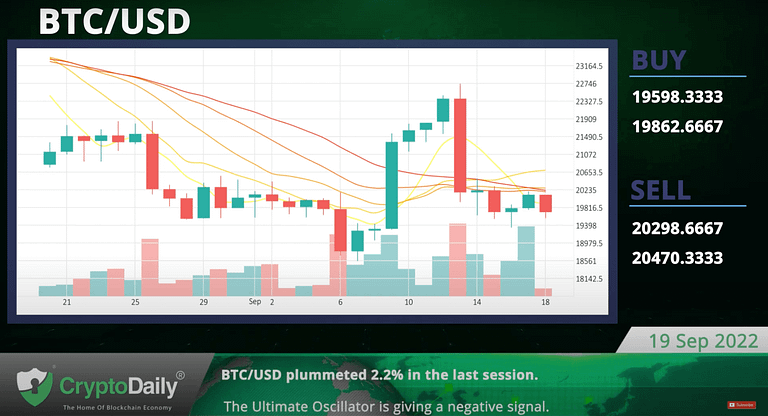

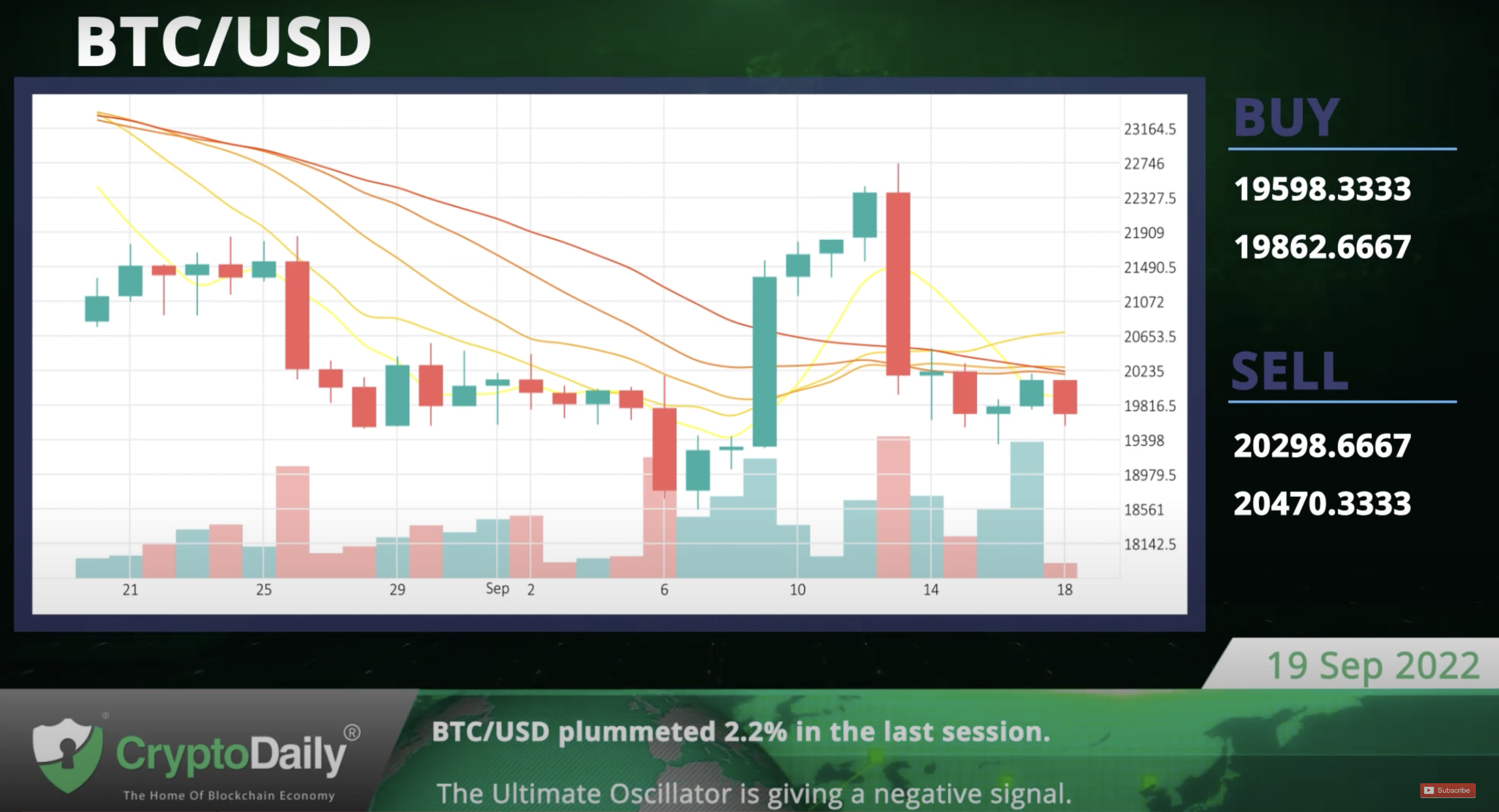

BTC/USD plummeted 2.2% in the last session.

The Bitcoin-Dollar pair dove 2.2% in the last session. The Ultimate Oscillator’s negative signal is in line with the overall technical analysis. Support is at 19598.3333 and resistance is at 20470.3333.

The Ultimate Oscillator is giving a negative signal.

ETH/USD dove 7.7% in the last session.

The Ethereum-Dollar pair plummeted 7.7% in the last session. The Stochastic indicator’s negative signal is in line with the overall technical analysis. Support is at 1385.451 and resistance is at 1516.671.

The Stochastic indicator is giving a negative signal.

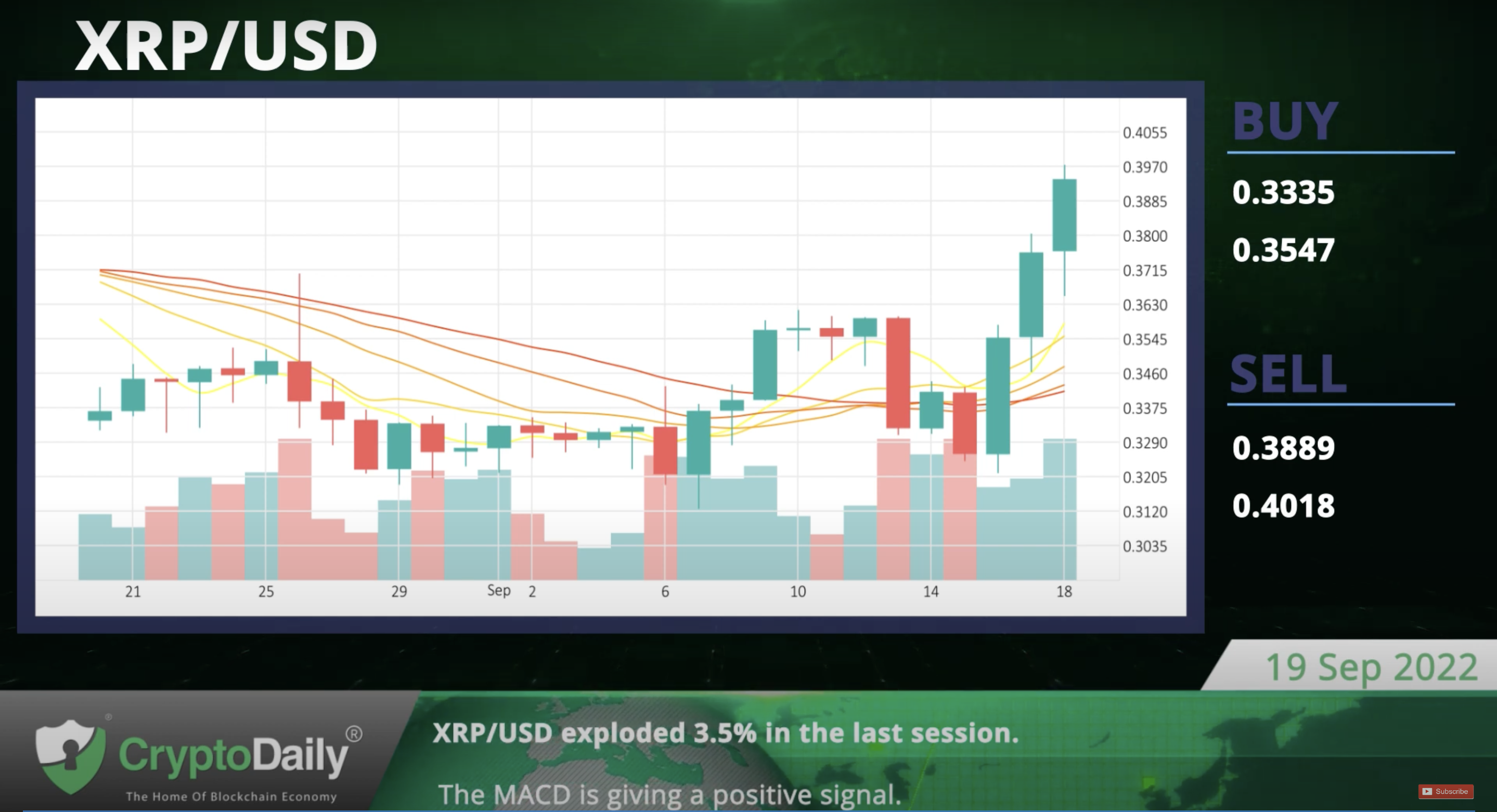

XRP/USD exploded 3.5% in the last session.

The Ripple-Dollar pair exploded 3.5% in the last session. The MACD is giving a positive signal. Support is at 0.3335 and resistance is at 0.4018.

The MACD is giving a positive signal.

LTC/USD plummeted 4.3% in the last session.

The Litecoin-Dollar pair plummeted 4.3% in the last session. The Stochastic indicator is giving a negative signal. Support is at 54.761 and resistance is at 59.921.

The Stochastic indicator is giving a negative signal.

Daily Economic Calendar:

US NAHB Housing Market Index

The NAHB Housing Market Index presents home sales and expected buildings in the future indicating housing market trends. The US NAHB Housing Market Index will be released at 14:00 GMT, the US 3-Month Bill Auction at 15:30 GMT, the US 6-Month Bill Auction at 15:30 GMT.

US 3-Month Bill Auction

Treasury bills are short-term securities maturing in one year or less. The yield on the bills represents the return an investor will receive by holding the bond until maturity.

US 6-Month Bill Auction

The auction sets the average yield on the bills auctioned by US Department of Treasury. Treasury bills are short-term securities maturing in one year or less. The yield on the bills represents the return an investor will receive.

EMU Construction Output

The Construction Output report captures the output of the construction industry, in both the private and public sectors. The Eurozone’s Construction Output will be released at 09:00 GMT, Germany’s German Buba Monthly Report at 10:00 GMT, Japan’s National Consumer Price Index at 23:30 GMT.

DE Buba Monthly Report

The German Buba Monthly Report, released by the Deutsche Bundesbank, contains relevant articles, speeches, statistical tables, and provides detailed analysis of current and future economic conditions.

JP National Consumer Price Index

The National Consumer Price Index is a measure of price movements obtained by comparing the retail prices of a representative shopping basket of goods and services.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

[ad_2]

Source link